How Much Is Insurance for Family of 4

10 Min Read | Jan xiv, 2022

The average individual in America pays $452 per month for market place health insurance. 1 But costs for wellness insurance coverage vary widely based on many factors.

Mayhap you lot just turned 26 and are off your parents' plan (#adulting?). Or possibly y'all're facing a job loss and need to supercede your former employer's coverage. Or you're only looking for other options likewise your employer's plan. No matter your situation, you lot're wondering: How much does wellness insurance price?

Everyone knows health insurance is expensive. It tin can pretty quickly suck the life out of your monthly budget. Just just how expensiveis it? And why is it so plush? Are at that place means yous can pay less?

Well, you lot're in the right place! I'll walk you through everything yous need to know nearly health insurance costs, what all those terms mean and what factors brand upwardly that hefty cost tag.

Basic Health Insurance Terms

If you're just learning the ins and outs of wellness insurance, I experience your pain. Wellness insurance is complicated stuff—similar rocket-scientific discipline complicated. You might non even know where to commencement. (And if you lot're wondering if health insurance is something you fifty-fifty need, start here.)

Do you have the right wellness insurance coverage? Connect with a Trusted pro today.

Earlier nosotros await at how much wellness insurance costs, let'south break down some terms into plain English.

First, there are only ii main kinds of health insurance—private and public.

Private coverage is wellness insurance through your employer, spousal relationship or even the armed forces. You lot can also get it on your ain through the government's marketplace—Healthcare.gov. (Quick history lesson: The marketplace, or exchange, was created in 2022 after the passage of the Affordable Care Act, or "Obamacare." It provides admission to effectually 175 insurance companies. In 2021, open enrollment was extended until August fifteen.)

Public insurance is provided by the authorities. It includes Medicare (for those 65 years or older), Medicaid (for low-income families) or care from the Department of Veterans Affairs.

Your premium is the corporeality you lot pay monthly (sometimes annually) for your coverage.

The deductible is the amount you have to fork over earlier your insurance company starts chipping in.

Your maximum out-of-pocket costs are the limit to what yous will pay in a year. For example, if your programme'southward maximum out-of-pocket costs are $eight,000, once you pay that amount, your insurance company will cover everything above that through the rest of the year. It acts equally a financial safety net and then you don't totally break the bank from medical costs.

What Is Individual Wellness Insurance?

Individual health insurance is just another term for private coverage every bit opposed to a group plan (similar those offered past an employer). It's simply the kind y'all get on your ain, even if you're including family unit members on your plan.

Yous might be looking for individual health insurance for a couple different reasons. If your employer doesn't offer it, if it's too expensive or if you're retiring before the historic period of 65. You lot'll too need it if you work part fourth dimension, you're unemployed or cocky-employed.

Plans offered in the marketplace are also examples of individual wellness insurance.

At present . . . let's dig into the numbers.

What Is the Boilerplate Cost of Health Insurance?

Maybe you're wondering, How much does individual health insurance cost? Hither's what you can expect. The average individual in America pays $452 per calendar month for marketplace health insurance in 2021.2 The average family pays $1,779 per month.3

Simply the cost of health insurance varies widely based on a bunch of factors. Some things are in your control, some aren't. Things like your historic period, how many people are on your programme, how much coverage you need, where y'all alive and who your employer is all play a role in the price of your coverage.

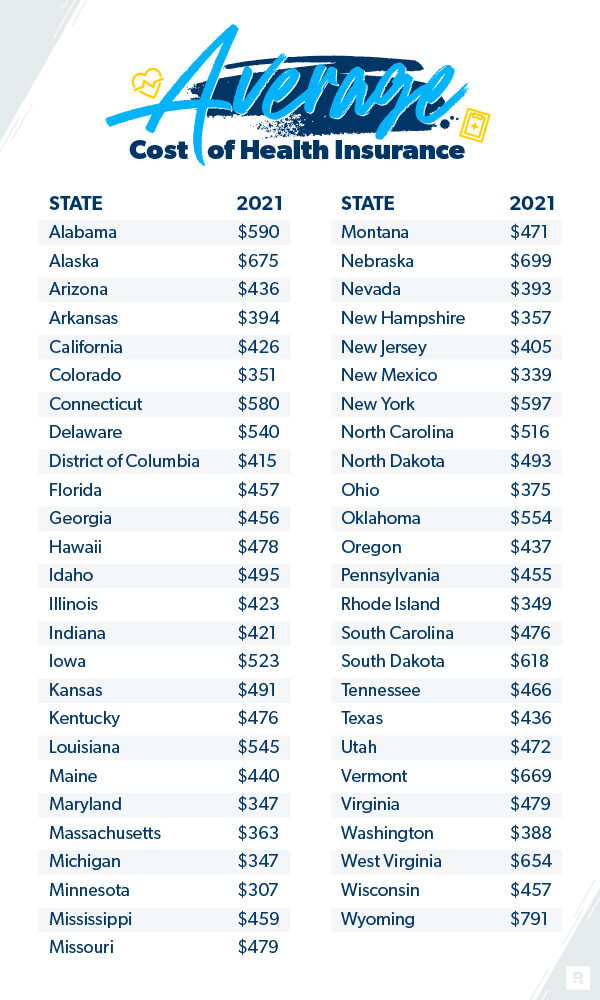

Here's a breakdown showing the average costs depending on your state:

Kaiser Family Foundation, 2021.

Is Employer Coverage Cheaper?

Many people presume that employer coverage is the best or cheapest option. In 2022 an estimated 157 one thousand thousand people opted for their employer-based health care plan.4

But is information technology? Should you lot e'er choose your employer'south health coverage or should yous opt for individual health insurance?

Employer plans can sometimes be less expensive since the visitor chips in part of the costs. Your employer can too sometimes get a improve rate because they're buying a large cake of insurance packages. Merely not always. It can sometimes exist cheaper to get health insurance on your own. While it might have a trivial more than work on your stop, if you're looking to save money on your health insurance costs, yous might desire to pass on the employer coverage and shop for an private programme.

Is Wellness Insurance Getting More Expensive?

It certainly feels like information technology. And it's true that over the last decade, wellness care costs have risen significantly. The average family is paying 55% more in their premium in 2022 versus 2010 according to the Kaiser Family Foundation.five And that number is upwards 22% since 2015.6 But premiums have only risen 4% when comparing 2022 against 2019.7

Wellness care costs also change based on where you alive. In some states they're upward, in other places they're lower.

If you feel like you lot're drowning in sky-high health insurance costs, there are some ways to save money on health insurance. Don't give up hope. You always have options, fifty-fifty if it just helps your budget a little. There are also some ways to save on health care costs your insurance doesn't embrace.

And if you lot're trying to cut costs while paying off debt, or you lot're simply starting to upkeep and barely making ends run across, you might want to choose a high-deductible and lower-premium plan that will kick in if yous have serious medical issues or an accident. This allows yous to focus on your necessities (at Ramsey, nosotros call them the Four Walls) before you tackle an expensive health intendance plan.

What Affects My Health Insurance Premium Costs?

Your Gender and Marital Condition

Nether the Affordable Care Act, insurance companies are no longer able to charge consumers more based on their gender.viii Merely other factors exercise brand a departure. For instance, if you're married and have kids, yous can expect to pay more to cover your family's needs. Note that if your family unit'south income falls beneath a certain level, a tax credit could save you money.9 (Bank check Healthcare.gov to see if you and your family qualify.)

Only marital status aren't the merely things that determine how much y'all could be shelling out. Hither are some other things insurance companies look for.

Your Personal Details

Age: When information technology comes to the cost of health insurance, age besides makes a divergence. The older y'all are, the more you lot'll pay for wellness insurance—sometimes up to three times more.10

Smoking: If you're a smoker, insurers tin can charge y'all up to 50% more for health insurance, unless you live in these 7 states: California, Connecticut, Massachusetts, New Jersey, New York, Rhode Island and Vermont.11 These states take passed laws confronting charging smokers more than. For everyone else, cutting out smoking and you could cut that bill in half!

Location:Premiumsvary by location. For case, in 2020, monthly premiums in the Northeast averaged $655 but only $626 in the Midwest.12 A family living in the Northeast averaged $one,929 compared to $1,716 in the South.thirteen

Different Types of Plans

Shopping for a health insurance plan can sometimes feel like being in a grocery shop and staring at rows of the same production for what seems like hours—merely information technology's less exciting andway more expensive! But comparing plans could save you coin. This is considering the type of plan you cull also affects your health insurance costs.

Here are the plans and networks you lot can shop for in the wellness insurance market:

- Health Maintenance Organization (HMO): HMO plans limit you lot to doctors within a sure network. They're usually the strictest plans but can take lower premiums.

- Preferred Provider Arrangement (PPO):PPO plans are similar to HMOs but give you lot a little more flexibility. Y'all'll pay less for medical intendance if y'all employ a provider within the program'south network. You are immune to admission out-of-network providers but they're more than expensive.

- Sectional Provider Arrangement (EPO): EPO plans limit you to in-network providers except for emergencies.

- Point of Service (POS): POS plans offer benefits similar lower medical bills if you use doctors, hospitals and health intendance providers in the program's network. Keep in listen y'all'll need a referral from your primary intendance doc in guild to see a specialist.

- High-Deductible Wellness Plan (HDHP): HDHP plans are exactly what they sound like. You lot pay a college-than-normal deductible just you become much lower premiums. You can too use pre-tax wellness savings accounts (HSAs) with these.

- Short-Term Plan: Brusk-term plans are temporary wellness insurance policies that bridge the gap when you're betwixt jobs. They're unremarkably from three months to merely under a year.

- COBRA Plan: Non to exist confused with a deadly snake, COBRA plans are similar to short-term plans but terminal longer. They assistance y'all prevent a gap in your coverage if you lose your job.

- Catastrophic Plans: Catastrophic plans mostly apply to immature adults nether the age of xxx. They take lower premiums and high deductibles.

Different Levels of Coverage

Okay, stay with me hither. I'1000 almost done with this marathon investigation into all things health insurance. I looked at the different types of plans, but there's a little more to information technology earlier nosotros put a bow on all this.

When it comes to market place health care plans, there are iv different levels—bronze, silvery, gold and platinum. Think of them like medals at the Olympics. (Except when it comes to health care, y'all don't always want to go for the gold!) These tiers requite you different options on how much your plan will actually pay out versus how muchyou'll pay. Also keep in listen they don't reflect quality of care.xiv

Mostly speaking, plans with a lower monthly premium will mean a college deductible, and vice versa.

Bronze is one step upwardly from a catastrophic programme. They give you lower monthly costs, but more out-of-pocket expenses.

Argent offers lower deductibles and out-of-pocket costs than Statuary, but you'll pay more than in monthly premiums. And depending on your income, silver plans also come with discounts chosen price-sharing reductions where the provider could embrace costs upwards to the 90% mark.

Gold plans have high monthly premiums only low deductibles, coinsurance and out-of-pocket costs.

Platinum is the highest monthly premium out there, with the lowest out-of-pocket costs. This type of coverage means y'all're really putting all your eggs in that large monthly premium handbasket! Simply having a lower deductible means your insurance company will start covering those crazy wellness care expenses a lot sooner.

How to Become the All-time Health Insurance

If you're looking to buy health insurance on your own, y'all can just become to the websites of major health insurance companies in your expanse and run across what plans they provide. Y'all can compare plans on your own, although quotes will vary pretty widely.

Simply let's face information technology. This is a ton of work. Choosing the right wellness insurance plan for you or your family is a daunting task. And yous probably take meliorate things to do with your time than sifting through endless health insurance quotes.

That's why I recommend using our trusted and independent insurance agents for your health insurance needs. They'll wait at your situation and compare the best rates so y'all tin can get the coverage yous need. They'll help you understand the market place or fifty-fifty what your employer is offer. And the best thing? They're complimentary!

Connect with one of our insurance agents today.

About the author

George Kamel

Source: https://www.ramseysolutions.com/insurance/how-much-does-health-insurance-cost

0 Response to "How Much Is Insurance for Family of 4"

Post a Comment